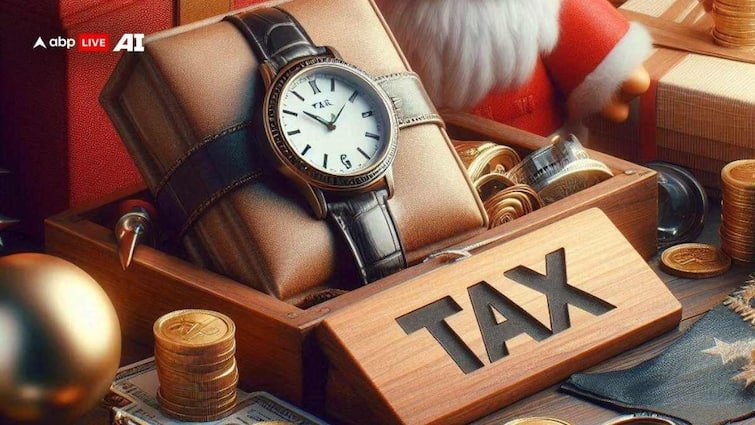

The Ambani wedding has been the talk of the town for months now and with the extravagant functions and outfits, the whole affair has captured the attention of Netizens completely. One such aspect of the wedding that has left everyone in awe is the groom’s gift for his groomsmen.

Groom Anant Ambani, the youngest child of billionaire Mukesh Ambani and Nita Ambani, tied the knot with Radhika Merchant in a larger than life ceremony on July 12. Keeping in line with the extravagance, the groom gifted some of his friends including Ranveer Singh and Shahrukh Khan a watch reportedly worth Rs 2 crore each.

While gifts are always appreciated, such a hefty gift might make you question about the tax implications on it. Let’s take a look at how gifts are taxed in India.

What Is A Gift?

Taxation on gifts comes directly under the Income Tax Act as the Gift Tax Act, 1958, was repealed in 1998. The Income Tax department defines a gift in three categories, namely, monetary gift, movable property gift (like paintings, jewellery, etc), and immovable property gift (like residential property).

Also Read : E-Filing Woes Spark Debate: Is I-T Department Planning An Extension Of ITR Deadline?

Tax Exemption On Gifts

- The law states that gifts worth up to Rs 50,000 received in a financial year remain exempted from tax. However, if the cash amount or gift amount exceeds the threshold, the entire gift becomes liable to be taxed.

- At the same time, gifts received by a bride or groom during their marriage remain completely exempted from tax. This exemption is applicable on all gifts, be it in the form of cash, jewellery, land, car, etc.

- Further, the authorities also exclude any gifts received from close-relatives from taxation. The list of close relatives include spouse, sibling of the individual or their spouse, siblings of parents or in-laws, grandparents, and grandchildren.

- Any gifts, monetary or otherwise, received from these people are exempted from tax, no matter the value of the gift. However, if the individual generates any income from the gift itself, that income will become taxable.

Any gifts falling outside these conditions remain liable for taxation. Gifts received from friends also attract tax, if the value of the gift exceeds Rs 50,000 in a year. The responsibility to declare a gift above the permissible amounts lies with the receiver. The value of the gift needs to be filed under ‘Income from Other Sources’ by the recipient of the gift and according to the value, the applicable tax slab will be levied on the gift.